It is an Alternative Performance Measure!

In our highly regulated world, financial statements of UK quoted companies must be drawn up and published in accordance with IFRS GAAP. Thus, the format of the income statement is prescribed and standardised. This is aimed at giving users confidence in the numbers that are reported. A regulated and standardised approach is designed to enhance comparability.

However, in addition many companies also voluntarily produce alternative performance measures (APMs). In other words, in addition to the various measures of performance outlined in the income statement (e.g. operating profit and profit after tax) other measures are published. This is a tacit acknowledgement that the information required by regulators do not wholly satisfactorily meet the information of needs of a company’s users.

After all, it should be acknowledged that one size does not fit all. APMs at their best seek to provide bespoke information about the company’s performance that will help the user better understand the performance of the company and even predict its future performance.

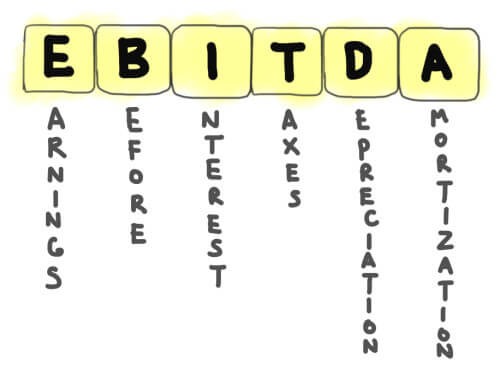

Earnings Before Interest Tax Depreciation and Amortisation (EBITDA)

This is probably the most famous of all APMs. Many companies even publish their own EBITDA even though it is not required, and not defined by any IFRS. So, let us explore why it can be argued that EBITDA is a useful measure of performance.

· Before interest. This is because companies are financed by different mixtures of debt and equity. Equity does not give rise to an interest expense, but debt does. Thus, by taking a performance measure before interest it enhances the comparability of the underlying performance of companies that have different financial structures.

· Before tax. This is because companies operate in different tax jurisdictions and suffer different tax rates accordingly. Thus, by taking a performance measure before tax this enhances the comparability between companies. Also, there is an argument that the tax expense is not under the control of management and so on that basis there more management accountability and stewardship on pre-tax earnings.

· Before Depreciation and Amortisation. This is partly because these are subjective non-cash expenses. However, another reason for taking a performance measure before depreciation and amortisation (and impairment losses) is because some companies grow by acquisition (takeovers) whilst others grow organically. The companies that grow by taking over other businesses will have more of these expenses. This is because acquisitions result in upward fair value adjustments on assets and thus subsequently more depreciation. In addition, the goodwill that arises on acquisition will eventually pass through the income statement in the form of impairment losses. Companies that grow organically will not have these additional expenses. Thus, by taking a performance measure before depreciation and amortisation (and impairment) it enhances the comparability of the underlying performance of companies that have historically pursued different growth strategies.

· Before Exceptional items. Whilst not in the acronym, when coming up with an alternative measure of performance companies often look to exclude unusual and non-recurring income and expenses. These are considered irrelevant when considering the expected impact on future performance. Excluding these one off items arguably enables users to understand the underlying performance, This makes the APM predictive and therefore more relevant to users.

Earnings Before Interest Tax Depreciation and Amortisation and Covid 19 (EBITDAC)

I have recently seen reports that some companies are considering reporting their 2020 profits before the effect of Covid 19. The suggestion is that it would be beneficial to adapt Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) so that it became Earnings Before Interest Tax Depreciation Amortisation and Covid 19 (EBITDAC). Lets consider whether EBITDAC would be a useful measure for users.

Because of the Covid 19 most business will have incurred additional costs. Impairment losses, provisions for redundancies and additional cleaning costs to name but three. These could be added back to EBITDA on the basis that they were non-recurring. However, given the likely duration of the Covid 19 impact this could be hard to argue.

Some might advocate that EBITDAC should also reflect additional hypothetical revenues and profits that would have earned if the Covid 19 had not occurred. I am very uncomfortable with this suggestion. The measurement of profit is part of stewardship and so should reflect what has happened. History should not be rewritten in this way. It could not be a faithful representation.

Conclusion

Whilst there is some merit in the measure of EBITDA, it seems a step too far for me to convert it into EBTIDAC. Users will be better served by management setting out a clear narrative explanation as to the future of the business in these uncertain times.

Tom Clendon is the SBR online lecturer. All his online courses come with full whats app support and mock exams on the ACCA practice platform.